CMSFORM.ORG – CMS-R-0235 D1 – DSH Data Use Agreement for Cost Reporting Periods Prior to those that include December 8, 2004 – In the ever-evolving landscape of healthcare data management, one agreement stands out as a pivotal piece in understanding the complexities of cost reporting prior to December 8, 2004. The intriguingly named CMS-R-0235 D1 – DSH Data Use Agreement holds within its provisions a treasure trove of insights and regulations that shed light on the intricacies of financial reporting in the healthcare sector. As we delve into the nuances of this agreement, we uncover not just legal jargon but a fascinating narrative that intertwines data integrity, compliance challenges, and historical context. Join us on a journey through time and bureaucracy as we unravel the mysteries behind this crucial document and explore its implications for stakeholders in the healthcare industry.

Download CMS-R-0235 D1 – DSH Data Use Agreement for Cost Reporting Periods Prior to those that include December 8, 2004

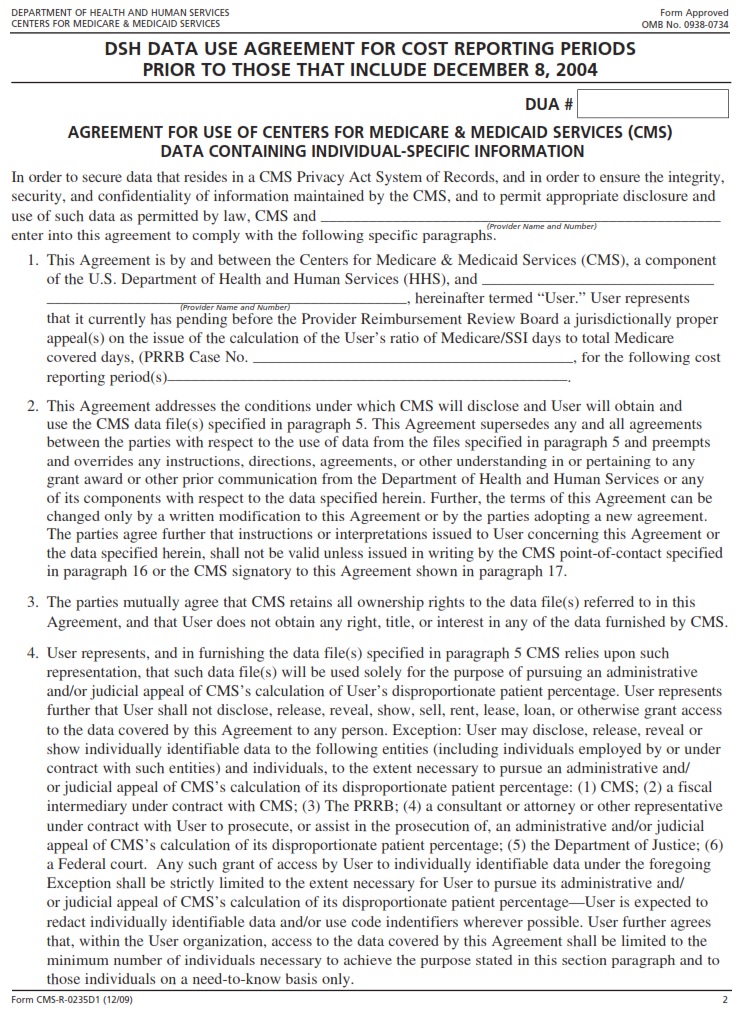

| Form Number | CMS-R-0235 D1 |

| Form Title | DSH Data Use Agreement for Cost Reporting Periods Prior to those that include December 8, 2004 |

| Published | 2009-12-01 |

| O.M.B. | 0938-0734 |

| File Size | 81 KB |

What is a CMS-R-0235 D1?

CMS-R-0235 D1 is a critical document that regulates data usage agreements for cost reporting periods preceding December 8, 2004, within the healthcare sector. This agreement outlines the terms and conditions for handling data related to Disproportionate Share Hospitals (DSH) during specified periods. By delineating specific guidelines for data management, CMS-R-0235 D1 ensures transparency and compliance in healthcare cost reporting practices.

Furthermore, understanding the intricacies of CMS-R-0235 D1 is essential for healthcare providers to adhere to regulatory requirements while accurately documenting costs associated with DSH facilities. Compliance with this agreement not only promotes financial accountability but also enhances data integrity within the health system. As healthcare landscapes continue to evolve, embracing these regulations becomes paramount in fostering trust among stakeholders and achieving optimal operational efficiency.

Where Can I Find a CMS-R-0235 D1?

If you’re in search of the elusive CMS-R-0235 D1 form for handling data use agreements relating to cost reporting periods preceding December 8, 2004, you might find yourself navigating a maze of bureaucratic procedures. This particular document is not readily available through standard online channels or at your local office supply store. Instead, your best bet would be to reach out directly to the Centers for Medicare & Medicaid Services (CMS) or their designated regional offices.

Additionally, consider tapping into industry resources such as healthcare compliance forums and professional associations where fellow administrators and consultants may have valuable insights on sourcing specific CMS forms like the CMS-R-0235 D1. Remember that persistence pays off in these situations, and staying proactive with your inquiries can lead you closer to obtaining the necessary documentation to streamline your cost reporting processes from eras past.

CMS-R-0235 D1 – DSH Data Use Agreement for Cost Reporting Periods Prior to those that include December 8, 2004

CMS-R-0235 D1, also known as the DSH Data Use Agreement for Cost Reporting Periods pre-dating December 8, 2004, signifies a pivotal moment in healthcare data management. This agreement sets the stage for ensuring the accuracy and integrity of Disproportionate Share Hospital (DSH) data used in cost reporting. By delineating specific guidelines and protocols for handling this critical information, CMS aims to enhance transparency and accountability within the healthcare sector.

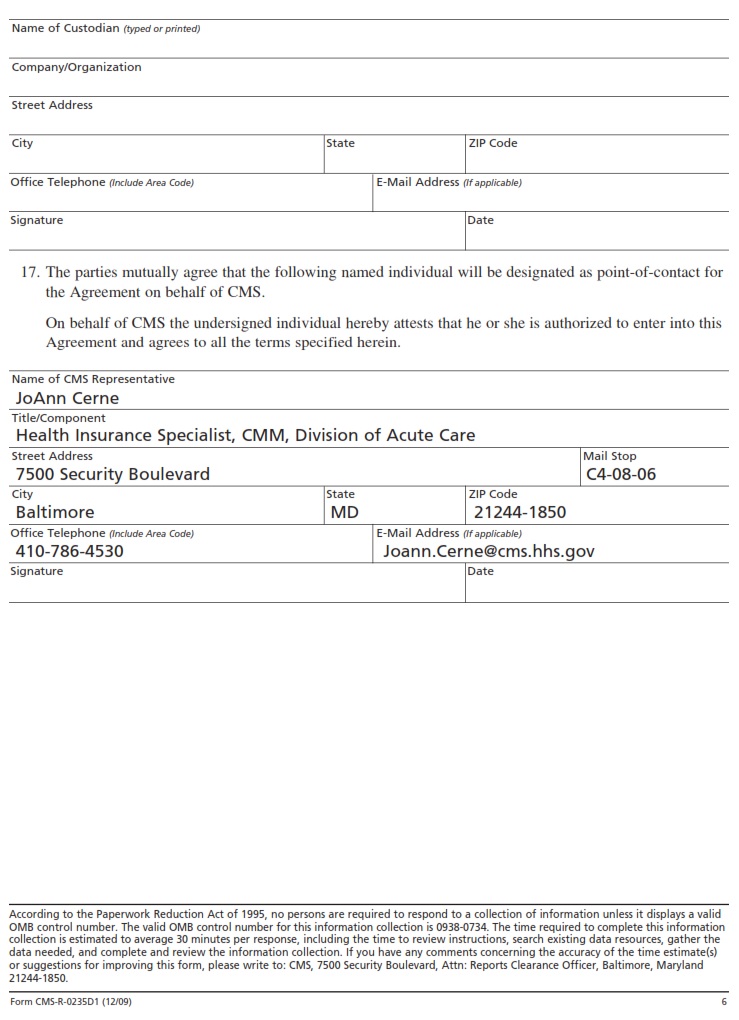

Prior to December 8, 2004, cost reporting periods faced numerous challenges in terms of consistency and reliability. The introduction of CMS-R-0235 D1 marks a proactive step towards standardizing data practices and promoting best practices across healthcare institutions nationwide. By adhering to this agreement, hospitals can ensure that their financial records are not only accurate but also comply with federal regulations pertaining to DSH payments.