CMSFORM.ORG – CMS 838 – Medicare Credit Balance Reporting Requirements – Navigating the complex world of healthcare billing and compliance can often feel like traversing a maze without a map. One particularly intricate puzzle that providers must solve is understanding and adhering to Medicare Credit Balance Reporting Requirements outlined in CMS 838. This regulation serves as a vital piece in the larger puzzle of Medicare reimbursement, requiring providers to meticulously report any overpayments received from the program. Failure to comply with these reporting requirements can lead to significant penalties and headaches for healthcare organizations, making it crucial for providers to grasp the intricacies of this regulation. In this article, we will delve into the nuances of CMS 838, demystifying its requirements and providing guidance on how providers can successfully navigate this challenging terrain.

Download CMS 838 – Medicare Credit Balance Reporting Requirements

| Form Number | CMS 838 |

| Form Title | Medicare Credit Balance Reporting Requirements |

| Published | 2003-10-01 |

| O.M.B. | 0938-0600 |

| File Size | 100 KB |

CMS 838 – Medicare Credit Balance Reporting Requirements (2682 downloads )

What is a CMS 838?

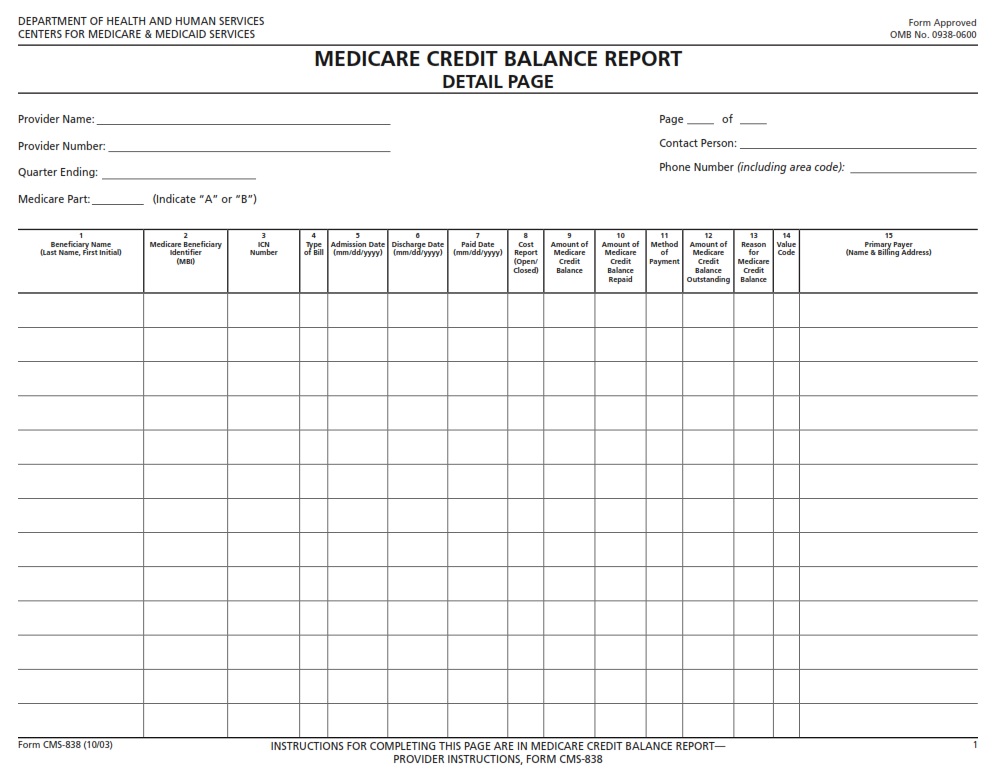

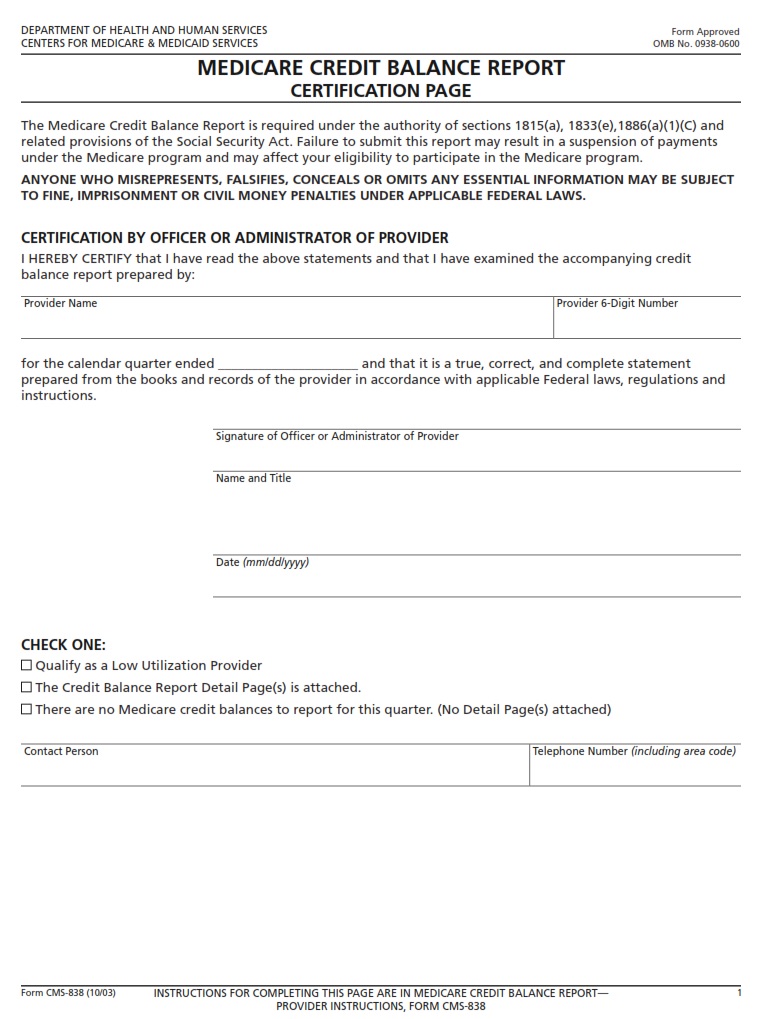

CMS 838 refers to the form used for Medicare Credit Balance Reporting, a crucial process for healthcare providers to reconcile overpayments from Medicare. This reporting requirement ensures that providers return any excess payments, thus maintaining compliance with Medicare regulations. By accurately completing and submitting CMS 838, providers not only follow legal obligations but also contribute to the integrity and sustainability of the Medicare program.

One key aspect of CMS 838 is its role in preventing fraud and abuse within the healthcare system. Through diligent credit balance reporting, providers can identify and rectify any discrepancies or errors in billing, reducing the risk of fraudulent activities. Additionally, by adhering to these reporting requirements, healthcare organizations demonstrate their commitment to ethical billing practices and financial transparency. Embracing CMS 838 as a tool for accountability can help foster trust between providers and government payers while supporting overall program efficiency and effectiveness.

Where Can I Find a CMS 838?

If you’re in search of a CMS 838 form for Medicare Credit Balance Reporting, you can easily access it on the official website of the Centers for Medicare and Medicaid Services (CMS). The form is readily available for download in PDF format, making it convenient for healthcare providers to submit their credit balance reports. Additionally, many healthcare billing software platforms also offer integration with the CMS 838 form, streamlining the reporting process and reducing manual errors.

For those looking to ensure compliance with Medicare regulations regarding credit balance reporting, obtaining a CMS 838 form is essential. It serves as a crucial tool for accurately documenting and reporting any overpayments identified by healthcare providers. By using this standardized form, organizations can demonstrate transparency and adherence to regulatory requirements, ultimately enhancing their credibility and trustworthiness within the healthcare industry.

CMS 838 – Medicare Credit Balance Reporting Requirements

Healthcare providers participating in Medicare must adhere to CMS 838 regulations regarding credit balance reporting. These requirements aim to ensure accurate accounting and prevent overpayments or discrepancies in reimbursements. By diligently following these guidelines, providers can maintain compliance with Medicare standards and avoid potential audits or penalties.

Effective management of credit balances is crucial for healthcare organizations to uphold financial integrity and demonstrate accountability in their billing practices. CMS 838 serves as a valuable framework for providers to streamline their reimbursement processes and minimize errors that could lead to costly repercussions. By embracing these reporting requirements proactively, organizations can enhance their operational efficiency while safeguarding their financial health in an ever-evolving healthcare landscape.