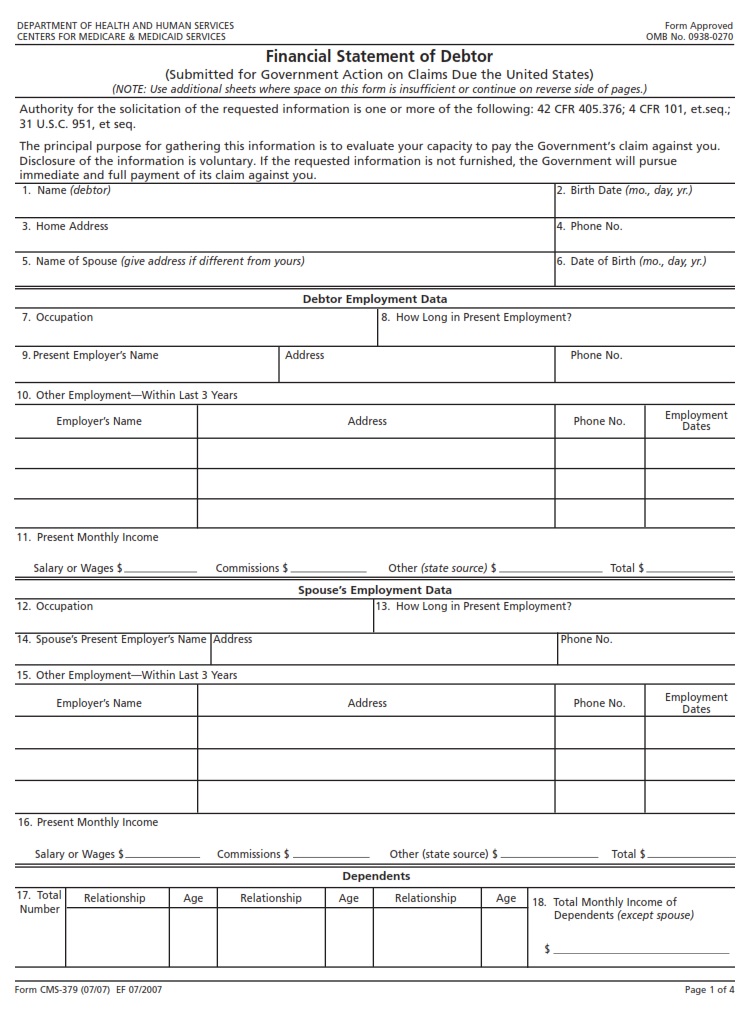

CMSFORM.ORG – CMS 379 – FINANCIAL STATEMENT OF DEBTOR – In the intricate world of finance, understanding the intricacies of a debtor’s financial statement is akin to deciphering a cryptic code that holds the key to their fiscal health. CMS 379 delves deep into this crucial aspect, shedding light on the dark corners of debtors’ financial positions and unravelling the mysteries hidden within balance sheets and income statements. Imagine peering through a magnifying glass at figures that seem to dance and weave a narrative of triumphs and setbacks, successes and struggles. In this article, we embark on an enlightening journey into the heart of financial transparency, where numbers speak louder than words and paint a vivid picture of an entity’s monetary past, present, and future. Join us as we explore the captivating world of debtor financial statements – where every digit tells a story waiting to be told.

Download CMS 379 – FINANCIAL STATEMENT OF DEBTOR

| Form Number | CMS 379 |

| Form Title | FINANCIAL STATEMENT OF DEBTOR |

| Published | 2007-07-01 |

| O.M.B. | 0938-0270 |

| File Size | 181 KB |

CMS 379 - FINANCIAL STATEMENT OF DEBTOR (2635 downloads )

What is a CMS 379?

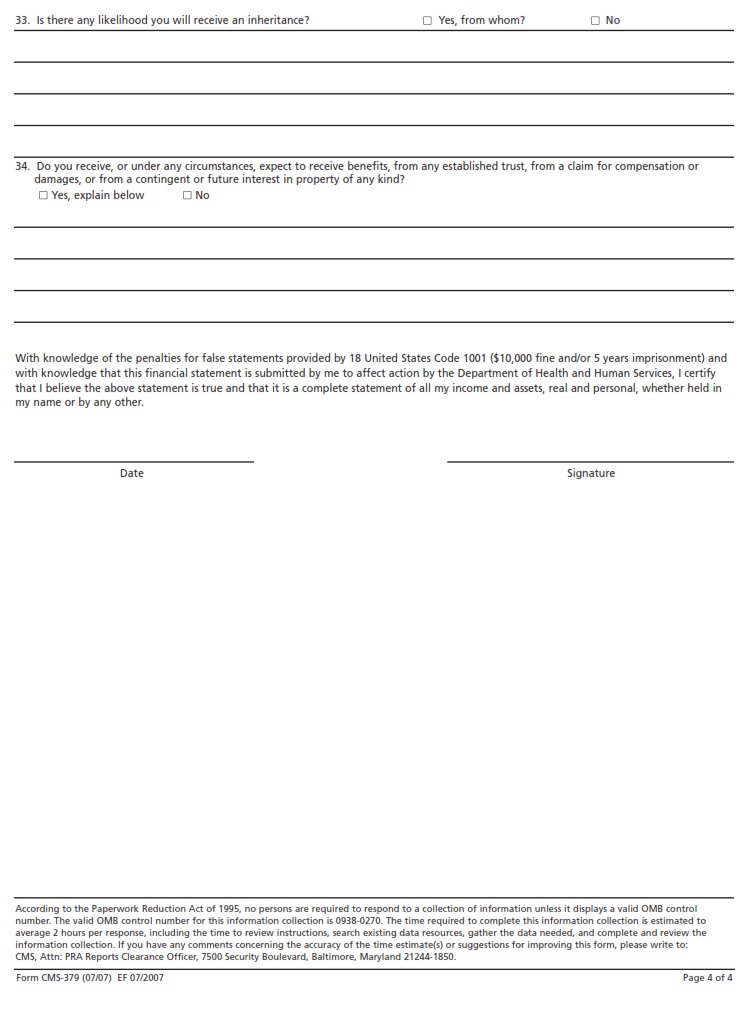

A CMS 379 form, also known as the Financial Statement of Debtor, serves as a crucial document in the realm of debt management and financial reporting. This form plays a significant role in providing creditors with detailed information about the financial status of a debtor, aiding in assessing their ability to repay debts. By requiring debtors to disclose their income, expenses, assets, and liabilities, the CMS 379 form offers a comprehensive view of an individual or entity’s financial health.

Moreover, the completion of a CMS 379 form is not just an administrative task but a strategic move for debtors to showcase transparency and commitment towards managing their financial obligations. With accurate and precise information provided on this form, debtors can establish credibility with creditors and improve their chances of negotiating favorable terms for repayment. Ultimately, understanding the significance and implications of the CMS 379 form is essential for debtors navigating through challenging financial circumstances and seeking to regain stability in their monetary affairs.

Where Can I Find a CMS 379?

You might be wondering where you can find a CMS 379 form for your financial statement needs. The process of locating this specific form can vary depending on your jurisdiction or the type of debt involved. In most cases, you can obtain the CMS 379 form directly from the relevant government agency responsible for overseeing debt collection processes.

Another option is to check with legal or financial professionals who specialize in debt-related matters, as they may have access to the necessary forms and expertise to assist you. Additionally, online resources and websites dedicated to debt management and financial statements may also provide downloadable versions of the CMS 379 form for easy access and convenience. Whether through official channels or professional assistance, obtaining a CMS 379 form should not be too challenging if you know where to look.

CMS 379 – FINANCIAL STATEMENT OF DEBTOR

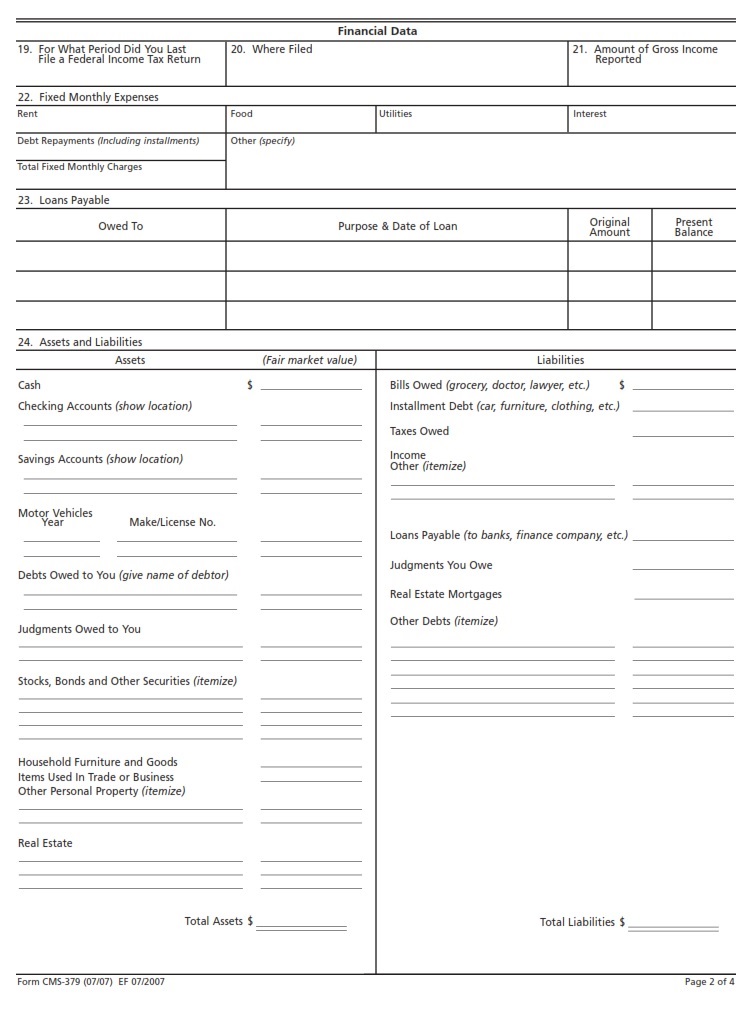

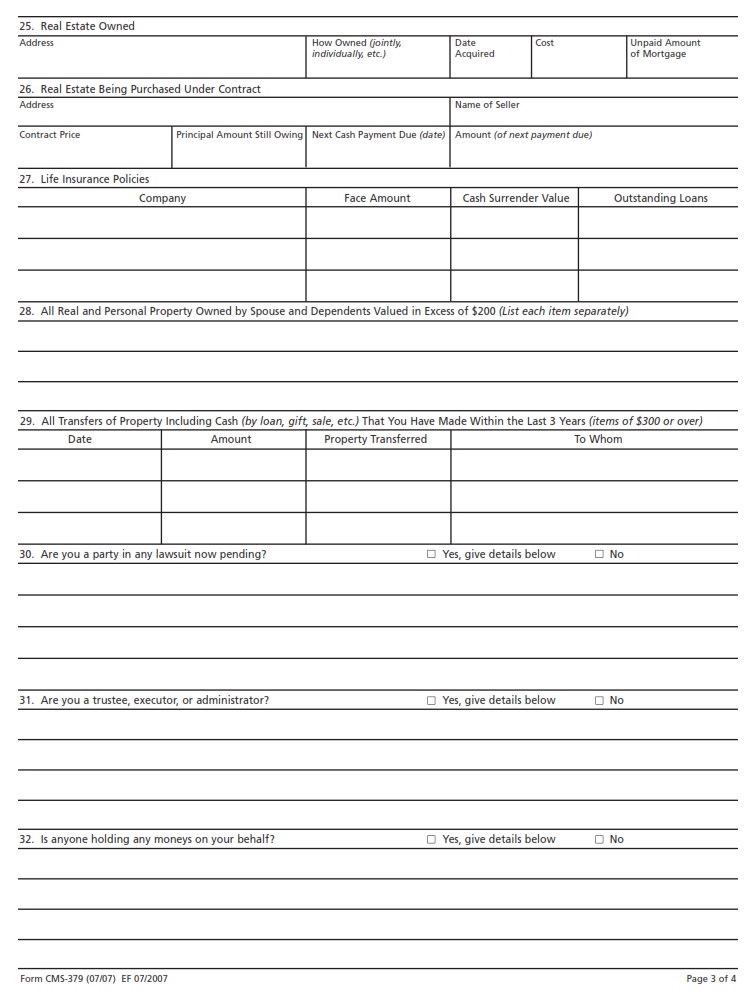

Understanding the financial statement of a debtor is crucial for creditors to assess the creditworthiness and repayment capability of an individual or entity. This document provides a detailed snapshot of the debtor’s financial health, including their assets, liabilities, income, and expenses. By analyzing this information, creditors can make informed decisions about extending credit or pursuing debt collection actions.

One key aspect of the financial statement is examining the debt-to-income ratio of the debtor. This ratio reflects how much of the debtor’s income goes towards servicing existing debts and helps creditors gauge their ability to take on additional debt or fulfill current obligations. Additionally, scrutinizing the types of debts listed on the financial statement can reveal patterns in spending habits and financial management skills.

By delving into the intricate details presented in a debtor’s financial statement, creditors can gain valuable insights into their repayment behavior and overall financial stability. This analysis enables creditors to tailor their approach when working with debtors to find mutually beneficial solutions that align with both parties’ interests. Transparency and communication are key components in navigating debtor-creditor relationships effectively while safeguarding against potential risks associated with lending money or providing goods/services on credit terms.